Key Themes Driving UK & Ireland Investors

Every June, Institutional Investor convenes the UK & Ireland’s leading pension funds, foundations and insurers to discuss the most pressing issues facing the industry in a confidential environment.

Held at London Syon Park, this year who’s-who of the UK & Ireland investment community explored how offensive or defensive they should be across several macro issues. Conversations evolved around portfolio positioning to beat inflation, shift from private to public markets, the rise of new outsourced investment solutions, and cash deployment and governance oversight following LDI crisis. Ahead of the event, Institutional Investor surveyed 40 asset owners on their asset allocations and investment intentions; 69% pension funds, 15% endowments, 15% consultants and 1% other. Here we present a snapshot and key trends captured:

High demand for liquid investments and fixed income – likely to be driven by combined factors of continued de-risking strategy for some institutional investors, as well as, more attractive yields offered by the asset class.

Demand for private markets and alternatives – Evidenced by real estate and infrastructure allocations. This is despite the pressures of the denominator effect and changes in risk appetite following the LDI crisis.

Planned decreases – No asset class is seeing a significant reduction although, equities is experiencing the largest planned decrease in allocations.

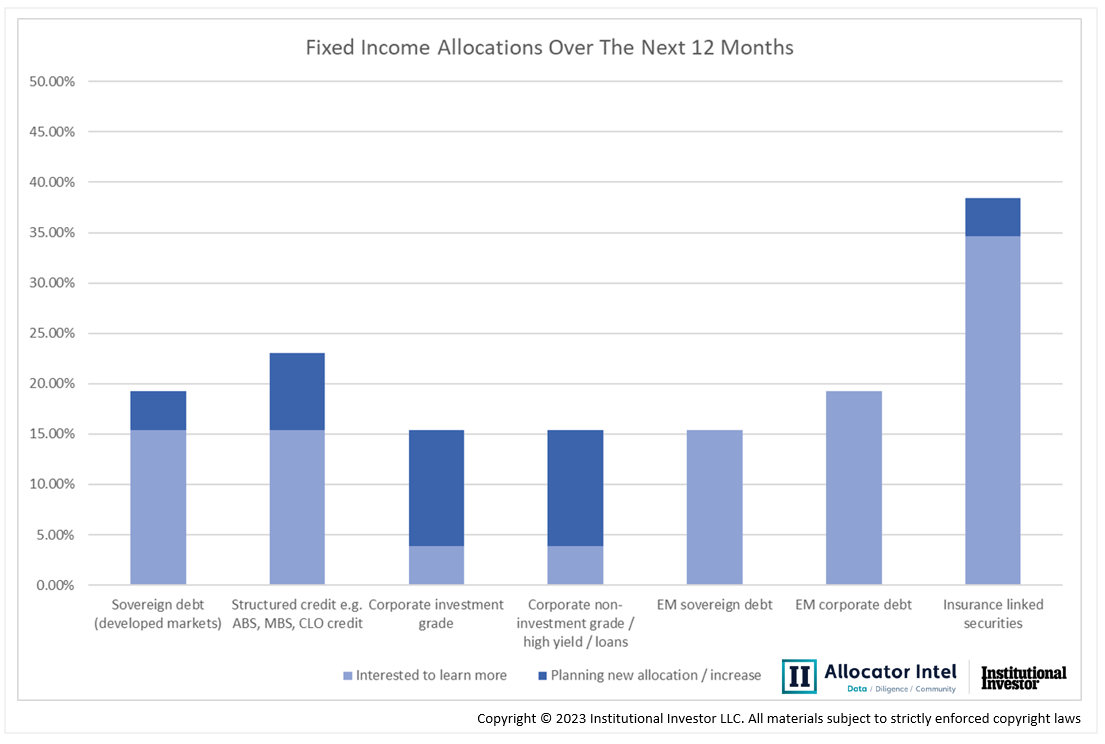

Fixed Income

The average allocation increase, of those planning an increase to allocation, is 6%. The biggest planned increases are expected to be seen in corporate investment and non-investment grade, with some additional allocations shifting to structured credit and sovereign debt. Allocations being made by a range of investors including corporate and public pension plans and endowments.

High interest in emerging market debt (both sovereign and corporate) however no planned additional mandates yet. Investors we have spoken with are still reluctant to commit to investing in emerging market debt.

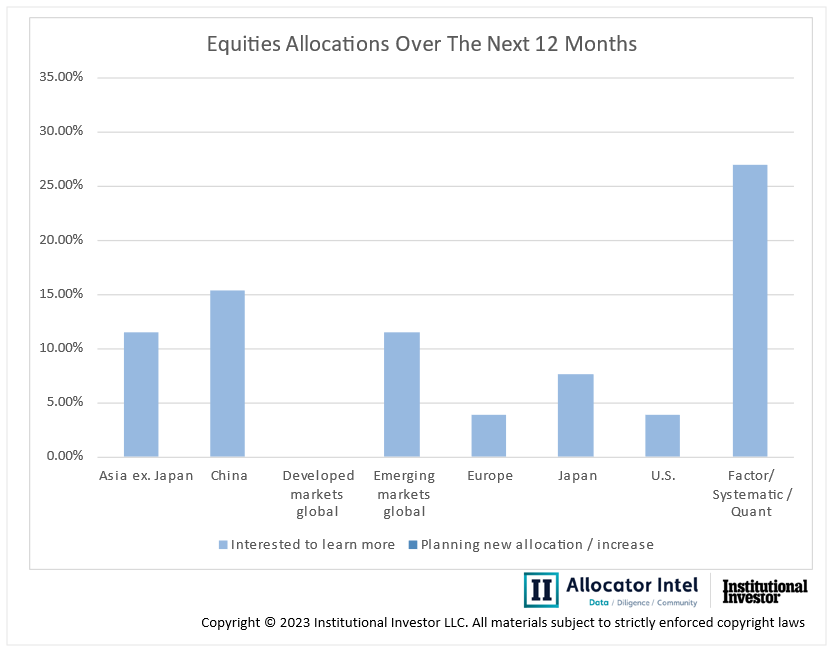

Equities

Considerable interest, limited planned execution. We are seeing significant interest in Factor/Systematic/Quant strategies, as well as across Asian, Chinese and emerging equities, with little interest in developed markets.

There are divergent views on equity allocations with one corporate plan intending to increase their allocation by 10% - although they have not specified which sub-asset class.

Meanwhile one pension fund is planning a 15% reduction in their equities portfolio and while one public pension pool, while reducing equity exposure by 5%, is increasing exposure to responsible/green equities by 2%.

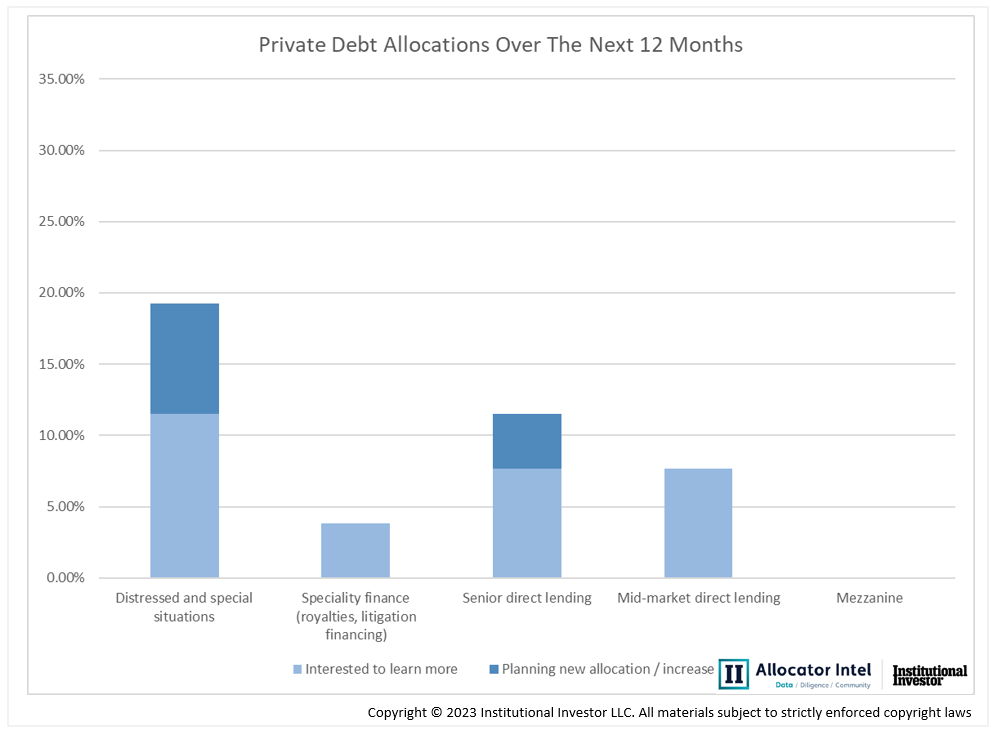

Private Debt

Mixed picture within private debt. Allocations to distressed and special situations as well as senior direct lending are increasing. However, other areas are relatively flat. The direction of travel is fund dependent with differing approaches.

Amongst those increasing their allocations, the biggest increase of +10% was from an endowment. Meanwhile, the biggest decrease was a corporate pension fund decreasing their total allocation to private debt by 8%.

Those withdrawing are part of a wider swing from private to public debt.

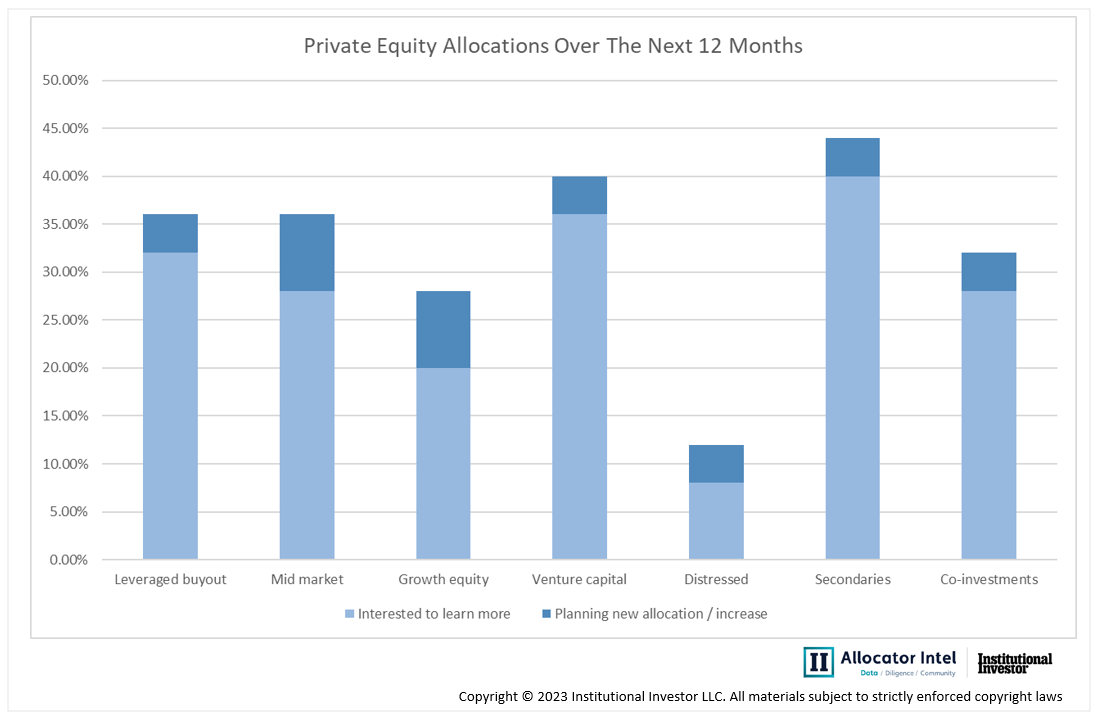

Private Equity

Increases across the board with larger mandates likely to be found in growth and mid-market equity. These sub asset classes proved the most popular for proposed increases.

We continue to see high interest in secondaries from investors looking to space. Significant interest in co-investment opportunities also continues.

Of those increasing, the largest increase to private equity allocation was by an endowment of 5%.

Real Estate, Agriculture and Timberland

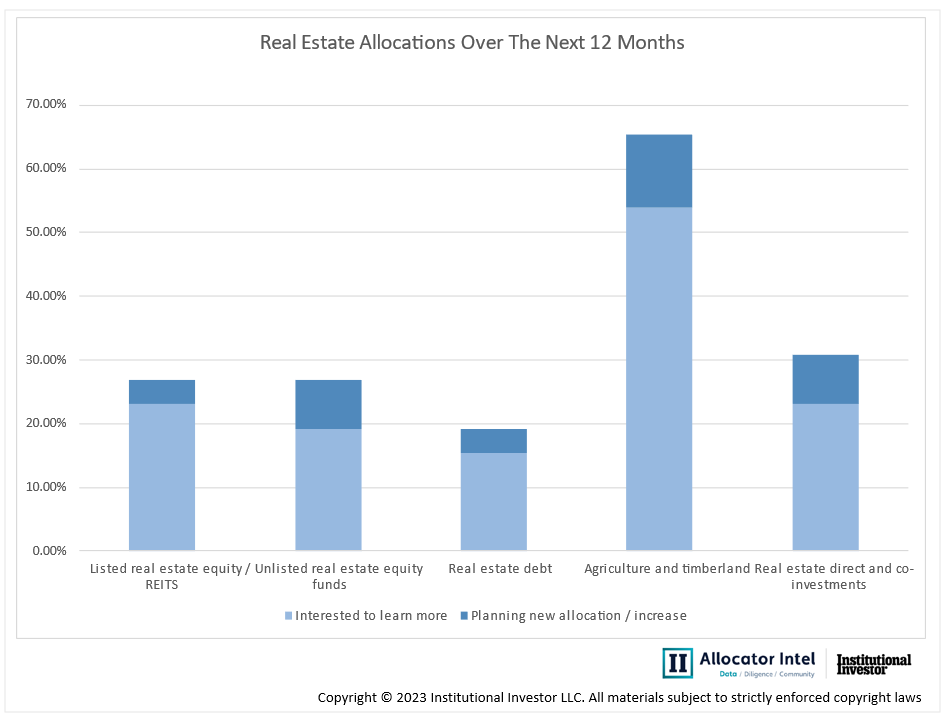

Strong appetite across the board with proposed new allocations in each sub asset class. As seen in 2021 and 2022 data, there remains significant interest in agriculture and timberland.

Relative to last year, there are more planned increases. This year, investors perhaps value the inflation resilience of real estate and inflation linked yields associated with the assets.

Some investors are less optimistic about real estate. One corporate pension fund is reducing exposure by 4.3%. However, the same scheme is reducing all private markets and alternatives exposure, favouring public markets for the next 12 months.

You can access a copy of the full report below.

If you have any questions please contact sam.ford@iilondon.com

To discuss the content of this article or gain access to like content, log in or request membership here.